Calumet Specialty Products (CLMT) fits the same basic mold as the rest of these conversion type companies, that is, you put crude oil in one end, and finished products come out the other. They run a handful of small refineries down around the Gulf, plus have a distribution center up in the midwest. About half of their product mix is typical refinery stuff, gasoline, jet fuel, and distillates, and the other half is a lot of specialty lubricants, plasticizers, process oils and that kind of thing that go into a variety of applications, including some medical. About 3/4 of their profits come from the specialty products division, and about 1/4 from the fuels, in a good month. Production, normally, is about 50/50.

Their average refinery throughput over the last few years has been about 54,000 bpd, which is a bad 45 minutes for Valero.

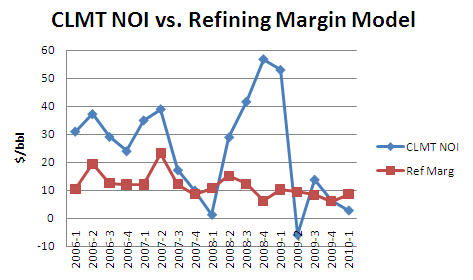

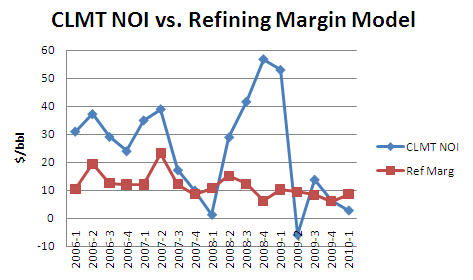

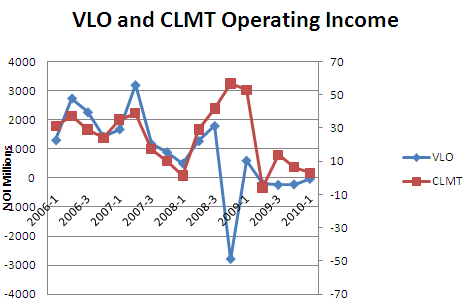

I did the calculation to compute the correlation between industry refining margins and their NOI and came up with the following:

We had developed a little model by which we were measuring the extent to which these companies' NOI is related to the industry refining margins, and for CLMT the R-squared value was .10, which means, their product mix is such that they have gotten completely away from the same commodity trap that some of the other companies in this business have been in. Valero was about .66, I think FTO was up around .85 when we used the same model to compare these refiners.

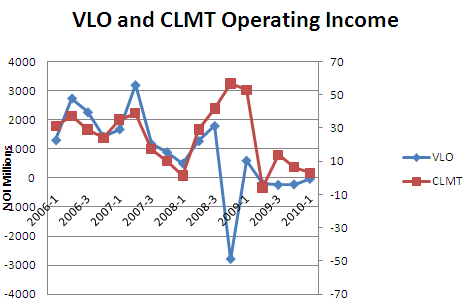

The comparison between VLO and CLMT is especially interesting:

Obviously these are on a completely different scale but you can see that when the economy was relatively strong, back in 2006 and 2007, they were doing just fine, but CLMT managed to mostly avoid the catastrophe at the end of 2008.

So, what is going on here?

If you take CLMT's top line, sales dollars, for their specialty products division, and divide by the crude oil throughput, it is on the order of $100 per barrel, which given $75 per barrel crude oil costs gives them a refining margin of $25 per barrel on these products, as opposed to the Valeros of the world who are delighted to break close to even right now after overhead.

CLMT's product differentiation does come at some expense. Their SG and A expenses of about $1.41 per barrel are about 100 times higher than Valero's, on a per-barrel basis because in a lot of the markets they are in they need to do some product development and technical service, and sales service activities. Also, because a lot of their products go into more technical markets downstream, such as FDA, they need to put more effort into regulatory compliance and quality control. Also, since they cannot be transported by pipeline, product transportation is a significant line item for them every quarter, hence the distribution center in the midwest. The sum of this, about $4 per barrel, is the cost of differentiation.

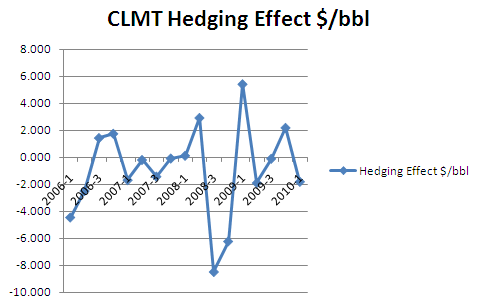

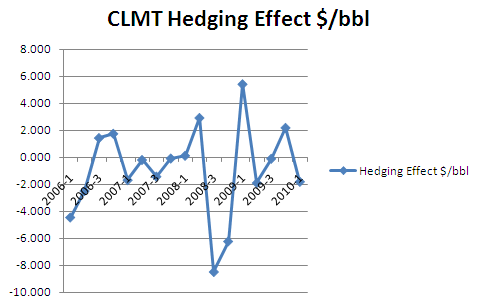

CLMT also engages in a lot of hedging/derivative activities to try to protect themselves from unexpected dramatic increases in the crude oil price. According to the quarterly reports, the effects of this on their balance sheet in any given quarter can be pretty substantial, and in fact, have a couple of times exceeded the amount of money they actually made running the plant.

This is a graph of their unrealized and realized hedging effects, per barrel, for CLMT during this time frame. If you take the total hedging effects, unrealized and realized ($68 million) and divide by the number of barrels they consumed during this period, the net effect was a cost of about $0.78 per barrel, which is cheap insurance against the cost of crude oil going out of sight, and it does confirm that they are not really trying to be a trading house, all they really want to do is build a little protection into their system so that they can make money doing what they do.

So they can inoculate themselves against crude oil pricing, but they cannot inoculate themselves against a general downturn in the end-use markets, and they are still down about 20% in crude oil throughput from the top of the economy.. Since they do have a little higher costs, they have to back off of their fuel production when the margins are low, which is what has happened over the last quarter or two. A lot of their end-use markets such as automotive are also still way down from their pre-recession high water marks.

There are a few other things in the background on this: The boss is a former chemical engineer, which is a point in his favor as far as I am concerned, and a lot of the management is from the refinery industry in various capacities. They have set up the company to be managed by a "partnership", which is to say, the common unitholders do not directly vote on the management. I suppose there are drawbacks and benefits to this but one of the real benefits is that if they happen to have a bad quarter, particularly if obscured by their hedging activities, they do not need to spend a lot of time explaining to a lot of pesky shareholders what happened and can run this thing for the long term. I think the instututional ownership of this place is 11%, much lower than the big players in this industry.

They have recently entered into an agreement with Lyondell, to do the marketing and distribution activities for some of its line of specialty products. This will allow them to use their already existing distribution network to expand their market of complimentary products without having to invest in capacity, which works for both Lyondell and Calumet.

They also are paying a dividend, which at the current moment, at a price of $17 per share might end up being around 10%, which is pretty substantial, and if you look at their two-year chart, they are trading within a dollar or two of what they were in 2008, although they were beaten down a little based on the last quarter results which reflected this curtailing of their production.

I couldn't resist posting this stock chart.... which reflects the 50% loss in stock value for Valero for this period of time.... but the potential drawback is that in the event the market and/or the economy returns to some normal state, the shareholders of CLMT are probably not going to see as much capital appreciation on the upside either.

So, if you are a bit conservative, and you still insist on being in this nasty, thankless refinery business, a small, stable, dividend paying alternative like CLMT might be a better way if you are willing to give up volatility and/or some upside in exchange for a consistent return.

Keep in mind that the world is full of perils, and there are no guarantees, as we are finding out every day.

:

Disclosure: none