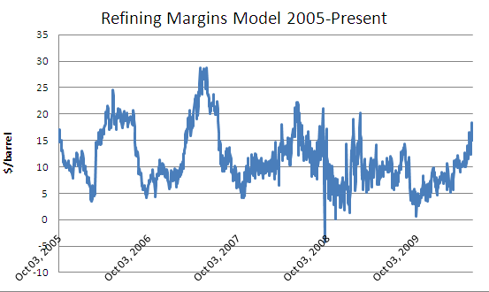

Of course, the actual gross variable margin varies a lot by company, depending on the product mix, and even by individual production unit. But, without complicating the problem too much, the model for the past few years has looked like this:

As you can see, within the last few weeks, it has recovered from the beat down experienced in late 2009 and has been looking a little better. Within the last few days, it's fallen to a bit under $11 per barrel. Note that It's not exactly the RBOB or HO crack spread, because it's a weighted average of the product mix, but it is a pretty good approximation of whether people are making any money in this business, particularly if you know the conversion cost per barrel.

Valero is an interesting company to look at sometimes, it's the largest independent refiner, they do very little upstream, and their claim to fame is the refineries they run along with the retail operations in the western 2/3 of the country. The company was put together a few years ago to buy low-entry-cost but relatively inefficient refining assets, a move which looked brilliant in 2006 when capacity was short, but for the last couple of years has been really not very good at all. They are a high-cost producer, they have lost money 5 out of the last 6 quarters, and they have recently taken steps to get out of the rut they are in by diversifying into some ethanol and alternative fuels, plus sell their worst performing refinery in Delaware.

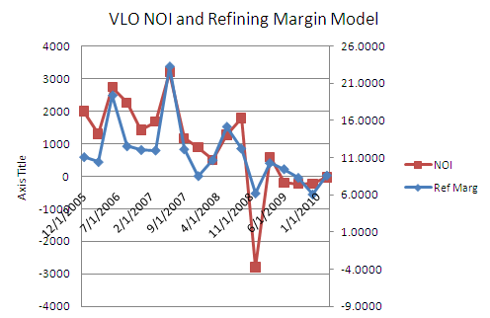

Our refinery margin calculation corresponds pretty closely to Valero's Net Operating Income (per their quarterly reports). In fact, you can see that it's the main driver of their profitability, This is not rocket science, no one is making money in retail so that is not much of a diversification.... You can see that in 2005-2006 they overachieved a little bit, in that period, capacity utilization was higher than it is right now and they had a bit more pricing leeway. Valero's production cost, per their financials, is usually between $6.50 and $7 per barrel. Some of the more efficient majors can get their product converted for $5-6, which means that they can stay profitable while VLO bleeds money.

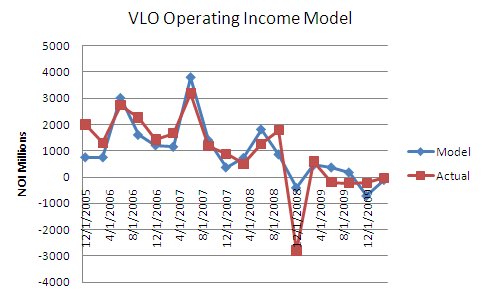

An even better approximation can be made by adjusting the model for the industry refinery utilization, which is a measurement of price strength (low utilization means terrible pricing) and by subtracting out the seasonality. R-squared for this little model is about .66, pretty good. It is not at all unheard of for profitability to be off a bit in timing, like it was in 2008, and also not at all unheard of for people to dump costs into the books if they know they are going to have a bad quarter, so maybe that is what happened in late 2008 when the market collapsed.

The very fact that the profitability of this outfit is so predictable is just an indication that their business is so commoditized, and to the credit of the management they are trying to make some changes in their business to lower their conversion costs and get into some other line of business to get them out of the equation. In the meantime, we can use this information to try to predict what they're going to do in the upcoming few months. Of course it depends on what you expect the WTI and products prices to be between now and the end of the quarter, but based on a reasonable set of assumptions (an $11 dollar weighted average refinery margin and 87 percent utilization) the model suggests their NOI for the June quarter is going to be in the neighborhood of $900M, which is the kind of quarter they had in early 2008, when they made in the low 40's per share. The analyst consensus for VLO for the upcoming quarter: the low 40's per share. They have some prospects to do a little better. The refinery margin model has averaged $12.71 up until May 14th.... We'll check back at the end of June to see how they're doing. Also, we should be able to unearth this model in a couple of years and see how good of a job they did in diversifying...because their profitability will correlate less well with the model.

Of course, all of this might or might not transfer directly to the stock price because these guys are bound to take a charge for discontinued operations, and the market itself is subject to chaos, Still it is nice to know a little ahead of time whether they are going to make a little money, and as time goes on, I am sure the management hopes that the changes can get them more consistently profitable through all parts of the business cycle which, despite rumor to the contrary, obviously still exists.

Disclosure: none